FINACLE TRAINING LESSON 15

Recap:

In the previous lesson, we have learned in detail about interest withdrawal process (reversal transaction) using HTM. In today’s lesson we will see more uses of HTM menu.

HTM Menu in Detail

As I said in the previous lesson, we can do all transactions in HTM. Yes! If you don’t believe me try yourself. But since we have dedicated menus for individual transactions let’s not complicate our work by using HTM.

But there are some other cases where we have to use HTM menu. Let’s see 2 such cases.

Cash Transfer from Vault.

How many of you got this error “Cash Limit Error” while verifying withdrawal transactions? Do you know why this error comes? Let’s see why it comes.

If you remember we have discussed in Lesson number 7 that every transaction in finacle will have two entries. Those two entries are 1. Credit entry 2. Debit entry.

When we do SB deposit transaction, customer’s SB account will be credited and Teller account will be debited. It means that when we accept deposits our teller cash position will increase but it will be in debit position. All these details we have clearly discussed in lesson no 7. Similarly while making withdrawal transactions customer SB account will be debited and teller cash position will be credited.

Here, the point to be noted is system will not allow SB withdrawal transaction if in teller cash position sufficient balance is not available in debit position.

Initially at the morning the teller cash position will be 0. Let us imagine that an RD deposit transaction is made for Rs.1000/-. Now the cash position will be 1000 in debit (Dr) position. See the image below.

As you can see after making the deposit Teller cash is debited by Rs.1000/-. So if we want to make any withdrawal transaction if the balance in Teller cash is less than the withdrawal amount system will show an error as “Cash Limit Error”.

Please note that to make any withdrawal transaction cash position must be in Dr Status only.

As a routine when we open the counter we take cash advance from Treasury. This advance transaction should also be done in the system. If you remember, while discussing about office accounts we have discussed about Vault account.

Vault is the equivalent of our Treasury. Small cash lockers are called CASH CHESTS. If the lockers are big like bigger than a house, then those lockers are called as VAULT.

So whatever advance we take from Treasury, the same advance transaction must be done in Finacle.

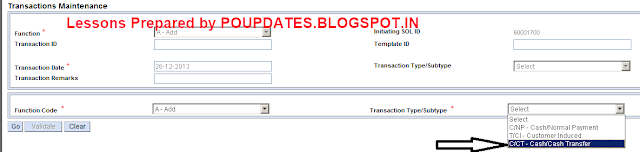

Let’s see how it done. We have to invoke HTM. Choose Function as ADD and Transaction Type/Sub type as C/CT – Cash/Cash Transfer and click on GO. See the image below.

After clicking on GO, the following screen. See the image now.

As you can see in the image, this screen is same as interest withdrawal screen. It will be same because we are using the same menu HTM.

Since we are taking advance from treasury we have to debit our teller id. Don’t get confused now. We have seen in the beginning of this lesson that while doing deposit transactions our teller account is getting debited. Similarly while taking advance from treasury we have to debit our teller account.

I hope you are getting my point.

So Choose part transaction type as Debit, enter your teller account Id and amount and then click on Add button. This is the first part transaction.

After clicking on the add button you will get the same screen again.

This is the second part transaction where we have to enter credit account details. Simple, just enter A/c id as vault account id {0406}, enter amount and choose part transaction type as Credit and click on post.

I hope you are getting my point. I really hope you have understood why we have debited the teller account id and credited the vault account.

Alternately in the second step after entering the account id, if you click the 3=3 button beside amount field, it will make all the necessary adjustments.

Cash Transfer to Vault.

Cash transfer to vault is very much similar to that of cash transfer from vault. In all these cash transfer transaction the only thing to keep in mind is which account getting debited and which account is getting credited.

If you know which account is getting debited and which account is getting credited it will be very easy for you to do these transactions.

In this case to transfer amount from Teller to Vault, we have to debit the vault account and credit the teller account.

We already know that when we do a withdrawal transaction in counter , customer’s account will get debited and teller account will get credited. Similarly to send cash to vault we have to credit the teller account and debit the vault account.

Now that we know which account to debit and which account to credit, follow the steps in above transactions and try this transaction too.

Cash Transfer between counters

Many offices have more than one counter in offices. There will be many such cases that counter PA will take cash from other counters instead of going to treasury. These cash transactions should also be done in the system. These transactions are also done in HTM menu only. All steps are same as we have done in the above two sections. Only thing is we have to identify which account should be debited and which account should be credited.

I’ll tell you a simple way to remember this without getting confused.

Debit the teller account of the person who is accepting cash

Credit the teller account of the person who is giving cash

Simple, isn’t it? Now you know which account to debit and which account to credit. Follow the steps which we already discussed in this lesson and do the transactions.

Other uses of HTM menu

If you see in FUNCTION of HTM there are 5 options.

Add

Modify

Inquire

Delete

Verify

Now we know why we use Add and Verify options. Inquire is to do inquiry of transactions. Whatever be the transaction just choose function as Inquire and enter transaction ID and finacle will show the details of the transactions.

Modify is used to modify the State of the transaction from entered to posted state. It doesn’t mean you can modify the entire transaction details. NO! We cannot modify any details of any transaction once it is done.

Delete is used to delete the transactions. We already know that only entered state transactions can be deleted. So if you have mistakenly entered SB withdrawal as 66000 instead of 6600 you can delete that transaction using HTM and re do the transaction.

Any transaction can be verified using HTM menu. If you see any pending transactions in HFTI and you don’t know which menu to verify that transaction, simply use HTM menu to verify that transaction.

It is also possible to do multiple BO RD transactions as a single transaction using HTM menu but there should not be any default or rebate for those BO RD transactions. Debit account id will be {0339} and credit account ids will be RD account numbers. Note: We never tried this because we never worked in offices with BOs! So use this option at your own risk.

One last point before we conclude this lesson. People say that there is no option to view signature in HTM menu while doing interest withdrawal transactions. We enter sundry account number in A/c id field. Do you expect sundry account to have a signature? To view the signature of the MIS/TD/SCSS accounts first enter the actual MIS/TD/SCSS account number in A/c id field and press F9. System will then show you the signature. If you are convinced with the signature, then again do the normal withdrawal process. Hope you have got my point.

SO, that’s it for today’s lesson. Hope you have learned some new points in this lesson. See you again tomorrow same time same place.

Read more